What we do.

Justice North provides representation, limited services, advice, or information to individuals with issues that fall outside of the criminal justice system. For people facing civil legal challenges such as the threat of losing their home, safety, health care, income, or even their families, navigating the justice system without a lawyer can be nearly impossible.

How do I get legal help?

You can apply for legal help by calling 877-MY-MN-LAW (877-696-6529), or you can begin your application online by clicking the button below.

How can I help?

Your donation will help build a more equitable world - one where justice is not a privilege only for those who can afford it. Civil legal issues can disrupt lives and destabilize families. Donations to Justice North from caring individuals, businesses, and organizations play a major role in continuing our work assisting people facing civil legal challenges.

Providing Legal Education in the Community

Justice North is committed to the well-being of our communities and the individuals who make up those communities. As the legal aid provider in our region, legal education is one of our fundamental duties. Whether we are providing resources and information during a local event or presenting to community members, we are honored to educate and inform regarding critical civil legal matters and the rights associated with them.

If you would like Justice North to present or attend a community event, please email us at outreach@justicenorth.org.

Find Legal Kiosks for Free Legal Help

Legal Kiosks are computers located throughout Minnesota that are free for anyone to use! If you have limited access to the internet or are struggling to get something done on your phone, you can find a nearby legal kiosk at LegalKiosk.org.

Legal Kiosks are stationed in a variety of community locations. You can use them to apply for legal help and access legal resources.

Some Legal Kiosks also allow you to attend online meetings and virtual court hearings in a private space and print for free! Visit LegalKiosk.org to find a location near you.

Legal Kiosks are computers located throughout Minnesota that are free for anyone to use! If you have limited access to the internet or are struggling to get something done on your phone, you can find a nearby legal kiosk at LegalKiosk.org.

Legal Kiosks are stationed in a variety of public community locations. You can use them to apply for legal help and access legal resources.

Some Legal Kiosks also allow you to attend online meetings and virtual court hearings in a private space and print for free!

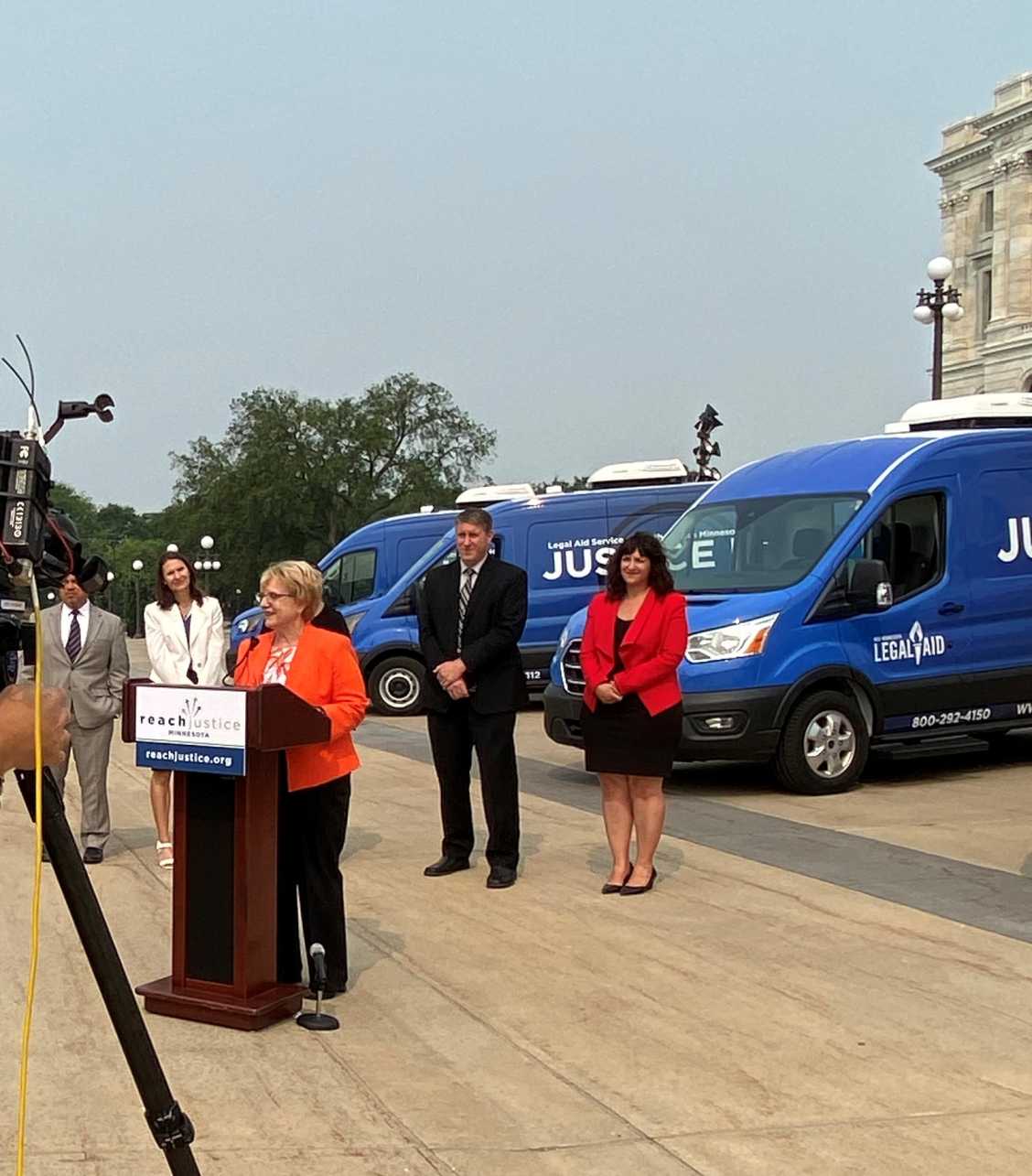

The Justice Bus

The Justice Bus is our legal aid office on wheels! The Justice bus is equipped with a computer, printer, office space, WiFi, and a wheelchair ramp. This allows us to travel to areas around our region and provide the same services on the road as we would at one of our office locations.

Mobile Office

The Justice Bus is a mobile legal aid office equipped with essential resources.

Outreach Support

Request the Justice Bus for outreach initiatives and community legal assistance.

If you would like to request the Justice Bus to attend your next outreach or community event to provide legal resources, information, or advice, please let us know by submitting the form below and we will be in touch with you shortly.

Justice North FAQ

Find answers to frequently asked questions about the services and programs offered by Justice North.

Justice North is a team of dedicated attorneys, paralegals, and legal support staff committed to closing the Justice Gap and protecting the legal rights of all community members.

We welcome volunteers and donations to support our mission. Please visit our website for more information on how to get involved.

We offer a wide range of legal services, including but not limited to legal advice, representation, and advocacy for various legal issues.

To make a donation, please click here to visit our donation page. Your support is greatly appreciated.

You can contact us by phone at 877-MY-MN-LAW (877-696-6529) or by email at info@justicenorth.org. We are available to assist you during business hours.